17 years helping Australian businesses

choose better software

ARGUS Enterprise

What Is ARGUS Enterprise?

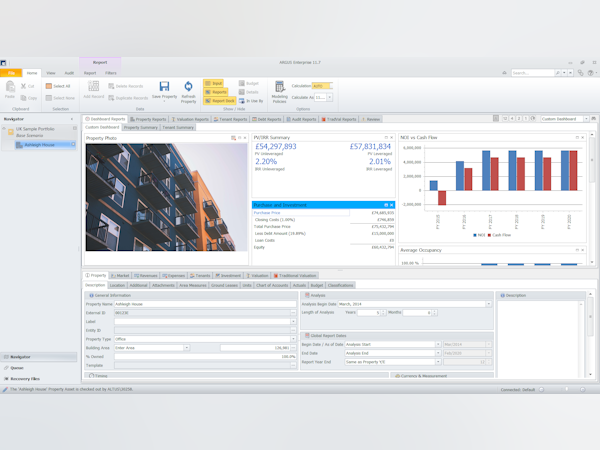

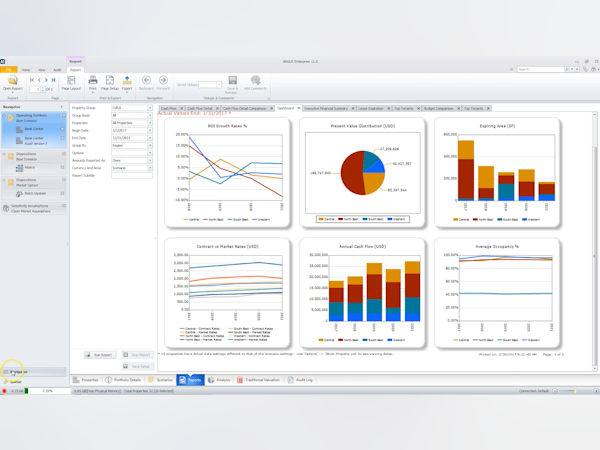

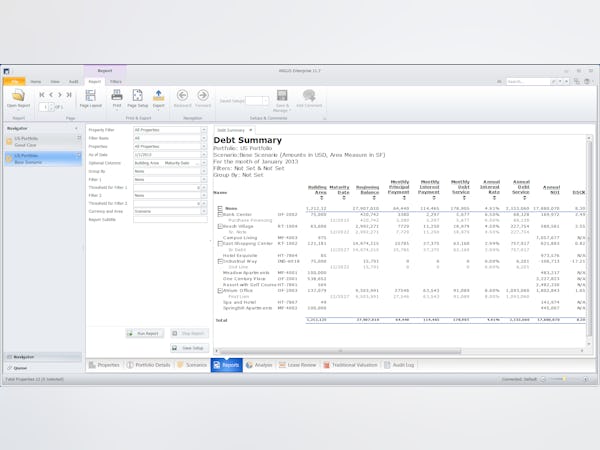

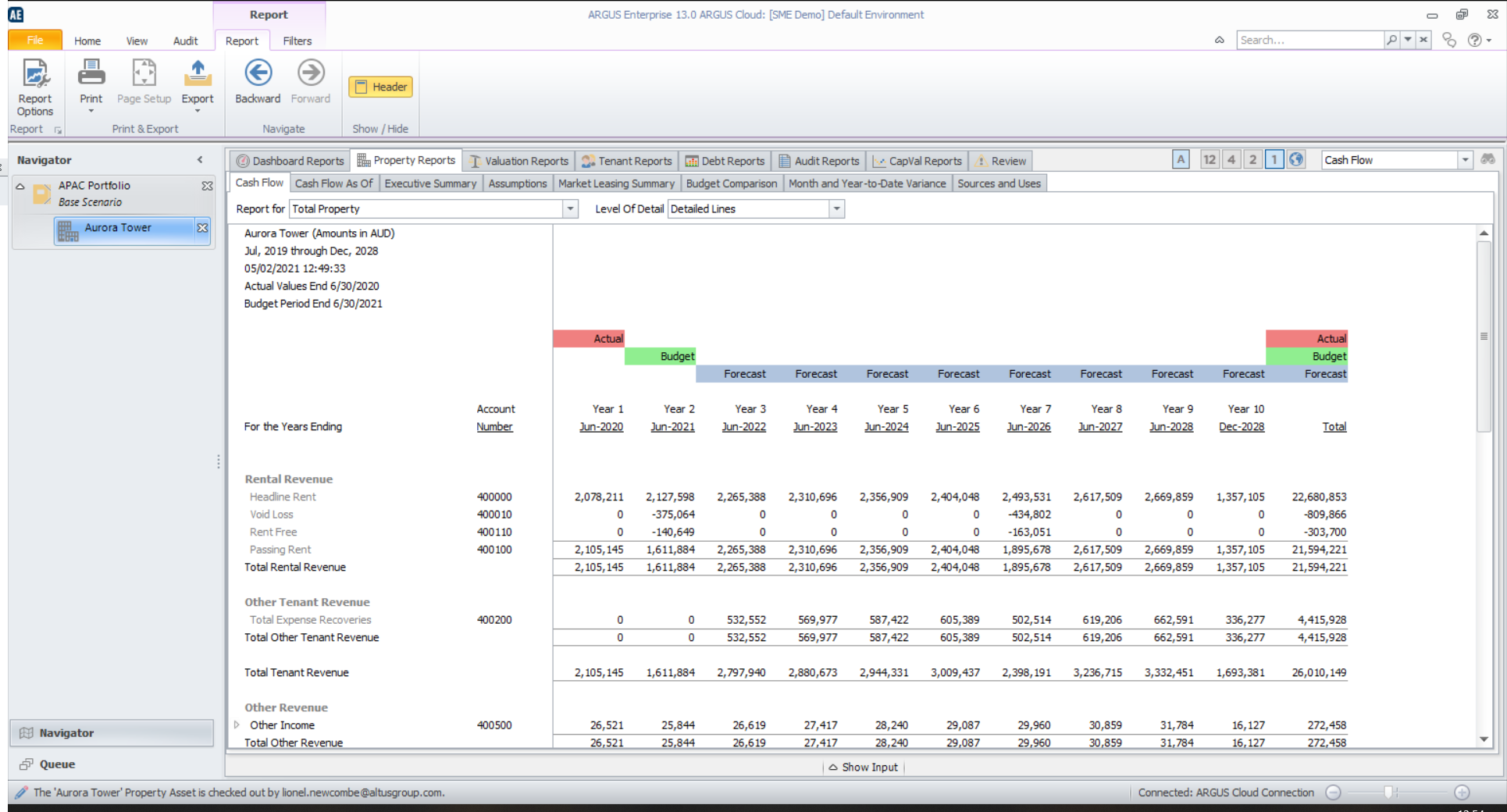

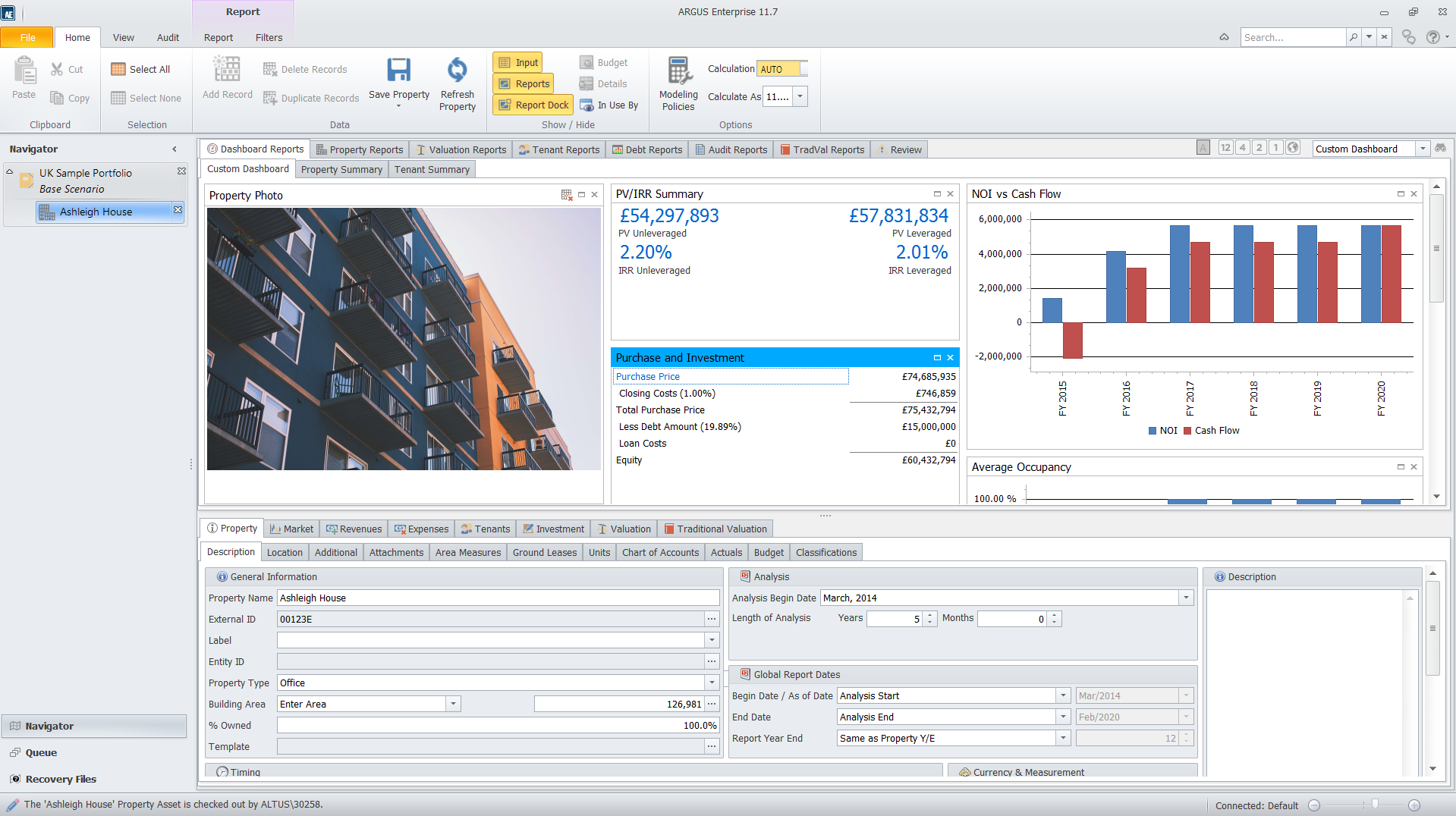

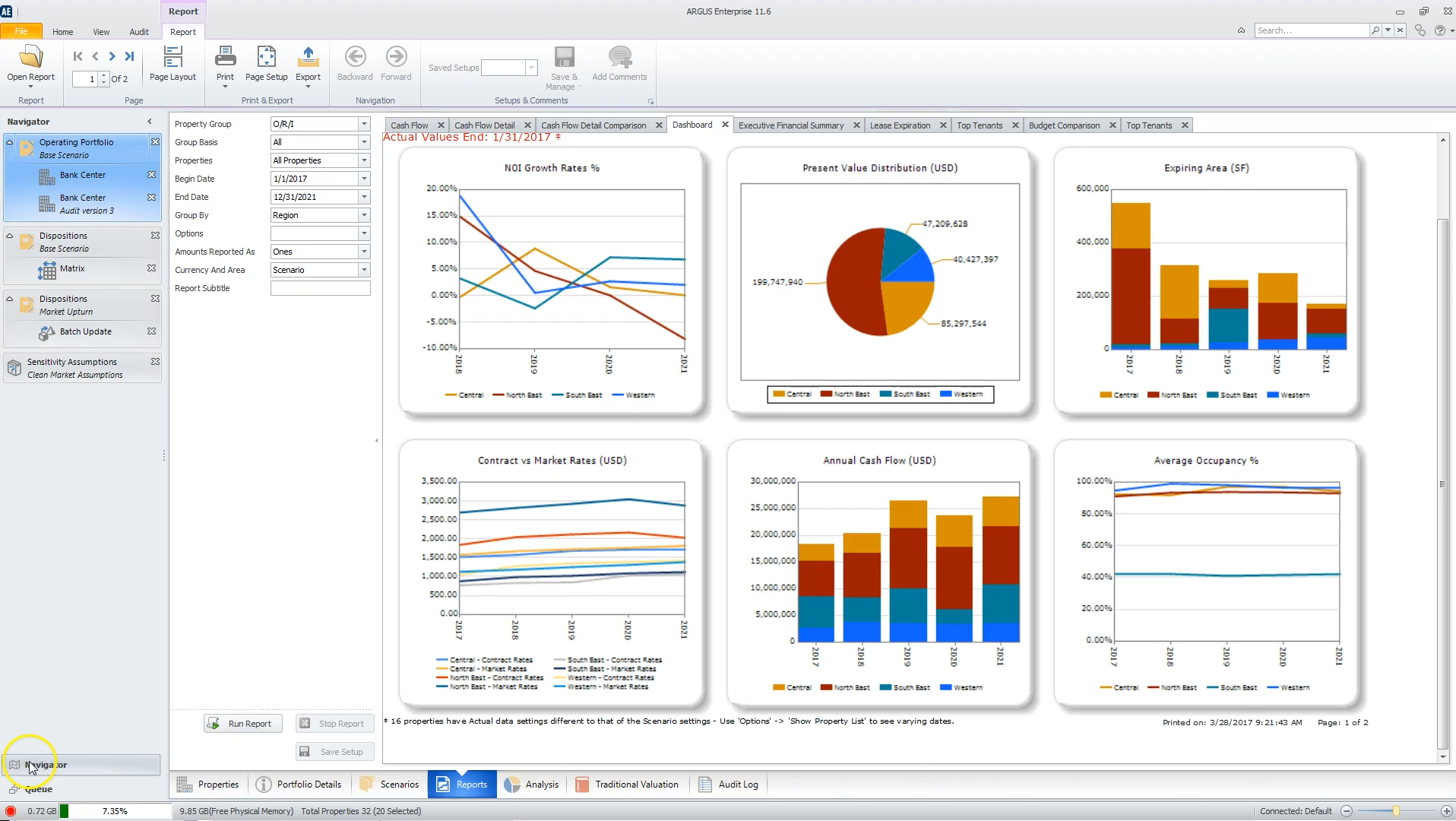

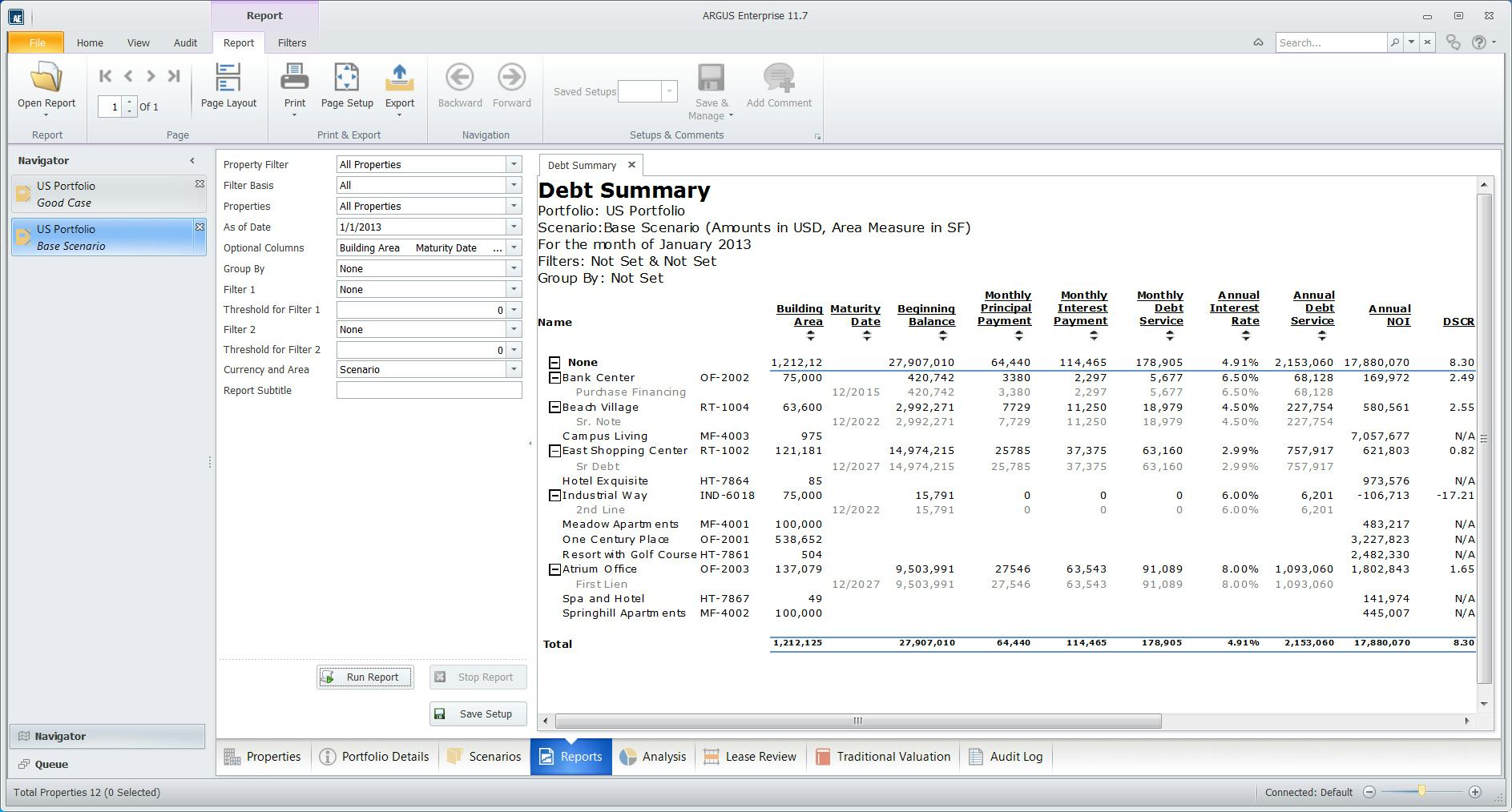

ARGUS Enterprise is a combination of our three best solutions – Valuation DCF, Valuation Capitalisation and DYNA Asset Management to enable you to run commercial property valuations and manage the performance of your real estate assets.

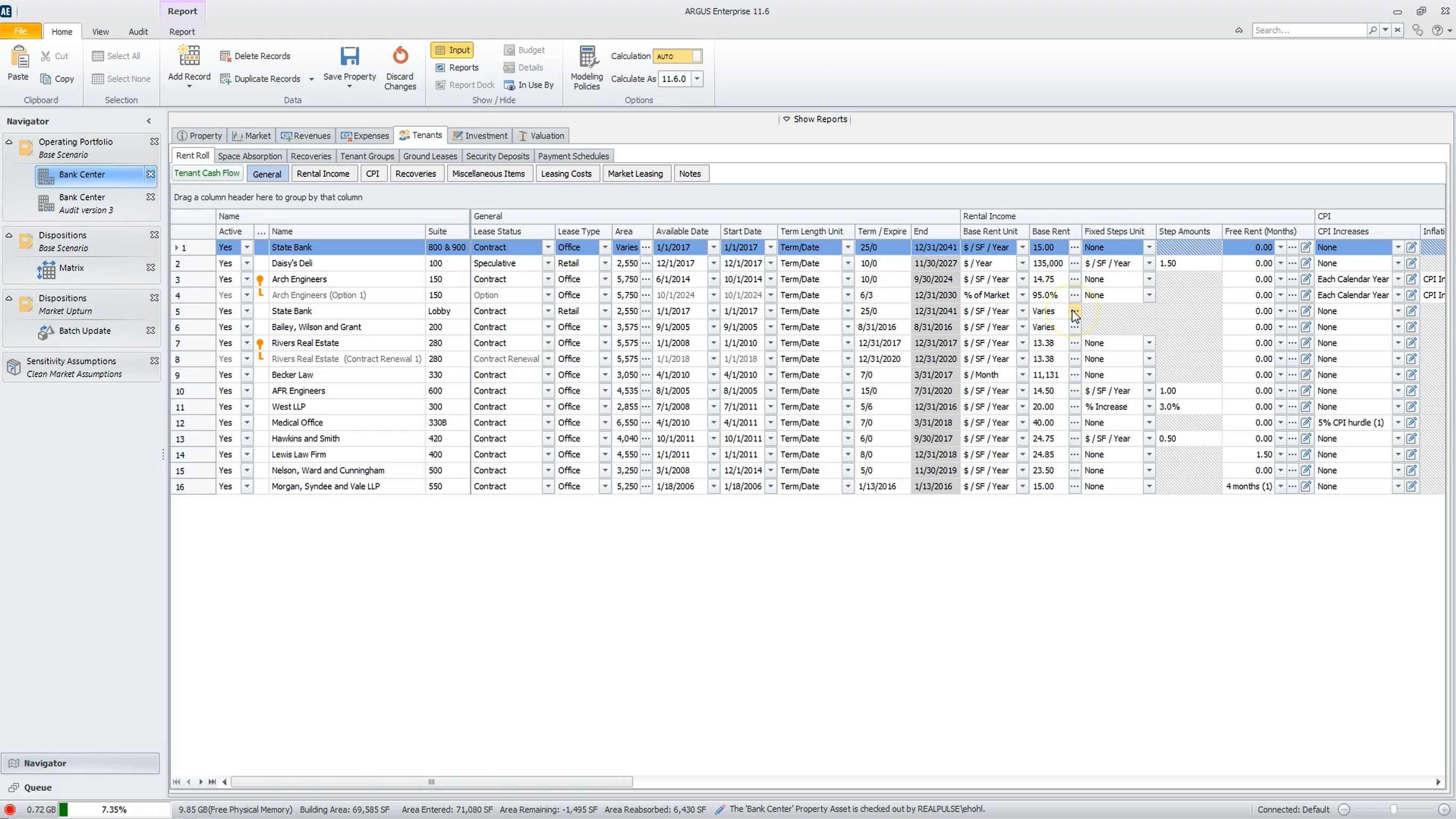

With one centralized solution, you can build detailed cash flow forecasts, stress test several scenarios, create comprehensive commercial property valuations and get in-depth insights to effectively manage asset performance and risk.

Who Uses ARGUS Enterprise?

Real estate asset and portfolio managers who value and/or manage commercial real estate assets including office, industrial and logistics, retail, multi-family/build-to-rent and hotels.

Not sure about ARGUS Enterprise?

Compare with a popular alternative

ARGUS Enterprise

Reviews of ARGUS Enterprise

Industry standard, but beware of monopolistic behavior...

Comments: I have been using Argus for years as it is critical for my job and throughout the real estate industry. Argus is used to underwrite/model real estate investments and its output is generally exported into Excel for further evaluation/manipulation. The software is powerful and generally intuitive, but it takes months of heavy use to achieve fluency. Changes through SaaS updates modifies functionality and features, which can be frustrating.

Pros:

Argus is the de facto software for the real estate industry and has been for decades. The software allows for discounted cash flow analysis of a variety of property types and various reports/schedules can be exported to Excel, where the heavy lifting often takes place. While the prior DCF version had some bugs/quirks, it was superior to AE in many ways. I understand the SaaS value from the firm's perspective, but the mandatory conversion from DCF was not handled well/strong arm tactic.

Cons:

Switch to SaaS vs. "owned" software and lack of support for legacy DCF. Expensive software for small businesses/individuals.

We use AE for budgeting and valuations. It's a pretty robust software.

Pros:

It has a lot of functionality and creates synergy between cash flow/budgeting and understanding building values. Some aspects are clunky and require work-arounds, but all in all it's very useful and has some great report features.

Cons:

Some of the user interface is complicated and rigid. For example, having a default to copy down & across rather than single value for expense entry causes many mistakes. It also is difficult to use percentage rent because rather than building up to a breakpoint based on a lease year, it divides the breakpoint by 12 and applies it to monthly sales. These are a just a couple examples of places that could be more user-friendly.

Argus Sucks

Comments: Argus is costly, very cumbersome to use, not the friendliest of the tools out there in the market place

Great product for underwriting

Pros:

We use this product to create rent rolls and cash flows for commercial properties in order to present them to potential lenders. It is easy to use, has great service when help is needed, and does everything we need it to in our line of work.

Cons:

You have to remember to save the file as you go, or you will lost everything if there is a glitch or you accidentally close out. It would also be nice if there was an undo button without going back to the last save.

Good for what we need but could improve

Comments: Keeping track of properties we are financing

Pros:

Customer service is terrific and the software is great for tracking tons of information on properties we finance. It is pretty easy to use and the training is great.

Cons:

Properties do not stay with the software, so if you login from another computer, your work is not there. You have to upload from a file. This is really time consuming and seems unnecessary if we're using the same login.

Administrator of the tool

Pros:

I administered Argus and it is a good tool for real estate management.

Cons:

Not much, has a lot of data, just need to get used to tool navigation.