17 years helping Australian businesses

choose better software

Macrobank

What Is Macrobank?

Macrobank by Advapay is a front-to-back banking software solution encompassing an engine, API, web and mobile interfaces, and back-end infrastructure equipped with all essential banking and payment functionalities. Endorsed by numerous regulators, it boasts flexibility and customization options, operates on an API-based architecture, and can be deployed either on the cloud or on-premises. It is available in both Software as a Service (SaaS) and perpetual licensing models, with the added option of purchasing source codes.

Key Features:

• Customers Onboarding & AML/KYC

• IBANs Generation and Multi-currency Accounts

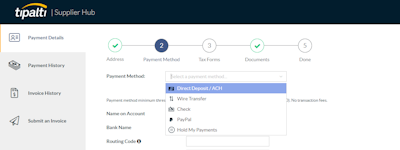

• Payment Processing

• Currency Exchange

• Tariff and Fee Management

• Co-branded Card Issuance

• Accounting and Reporting Tools

• Web and Mobile Banking Applications

• Two-factor Authentication App

It facilitates seamless integration with banks, payment service providers, BaaS platforms, AML/KYC services, card issuers, FX platforms, and other providers.

Who Uses Macrobank?

Best for digital banks, fintechs, licensed e-money and payment Institutions, MSB and remittance companies and e-wallets which are planning to provide digital banking services or money remittance.

Not sure about Macrobank?

Compare with a popular alternative

Macrobank

Reviews of Macrobank

Best core payments software for PSPs, EMIs, acquirers, small and specialised banks

Comments: We sincerely appreciate Canopus' professionalism when it comes to integrations with our partner banks, acquirers, and gateways, those integrations were carried on time and effortlessly, no matter how complex or complicated the APIs are. We wish you all the best in developing Canopus EpaySuite further, as it is a perfect affordable yet comprehensive solution for payments, electronic money institutions and specialized banks.

Pros:

We at PayAlly are very excited that all our business lines, such as payments, acquiring and card issuing could be easily incorporated into one solution. Comprehensive reporting tools and internal accounting module save us a lot of time and efforts in preparing our financial statements. Regulatory reports and fetching key data for management reporting can be produced within seconds. We have to complement on ease of use of Canopus EpaySuite, all our team members love it! It takes very little time to train an employee, as all modules are easy to read and understand, and are intuitive by nature.

Cons:

Absence of web based operator interface is the only downside.

Solution for financial business

Comments:

As the current project is the third one in last 17 years built on EpaySuite we haven't spent time on observing the functionality.

We have invested in to switch of the MSSQL to PostgreSQL, 1 years of 2 full time developers.

We manage:

- multibranch (7 companies within the group with several branches for some of them) in 3 different jurisdictions (bookkeeping rules), including in-house accounting,

- multicurrency including commodities,

- compliance procedures for the group and clientele,

- financial transactions including communication with the 3rd party providers,

- some functions helping to create comprehensive CRM based on 3rd party solution,

- reporting.

Pros:

Multibranch, multicurrency books and revaluation, clear logic, value for money and efficiency, flexible roles distribution.

Cons:

It needs certain tuning for the business needs, it can be done by ITs only. Old styled interface. Solution is based on MSSQL which could be relatively expensive.

:-)

Pros:

I used this system as customer few years. Respect.

Cons:

Simple and clear reactions of system. may be depends of setting of Business managers.

Reliable partner

Comments:

Canopus IT has become our reliable partner ensuring mutually beneficial cooperation. We particularly appreciated the efforts of your consulting experts who are creative in solving their tasks and thoroughly tackle all the issues at stake.

We are planning to continue cooperation with your company in developing our projects of payment technologies and integration of information and financial systems.

Pros:

We thank Canopus IT for our successful cooperation and provision of financial hi-tech software solutions. During our cooperation (since 2016) in application of Canopus software products for provision of new payment services to our clients we noted competence of Canopus IT employees in IT area, quick response and understanding of our needs as a client, desire of Canopus employees to do their work in time and with high quality.

Cons:

I don't see any issues at this time as any our question is resolved by support team.

It is completely suitable for the type of payment institution MoneyPolo operates.

Comments:

Being specially designed for payment institutions, ePay Suite offers in its

standard version far more useful features than the competition and provides a

complete support of both back office and multi-channel front end.

Another strong point of ePay Suite is the fact that it is built on core banking

technology ensuring the appropriate robustness, reliability and overall security

while offering such useful banking functionality as integrated customer

information file with KYC, CDD and EDD features, AML / CTF module,

correspondent banking facility as well as in-built workflow engine, general ledger

and a reporting tool.